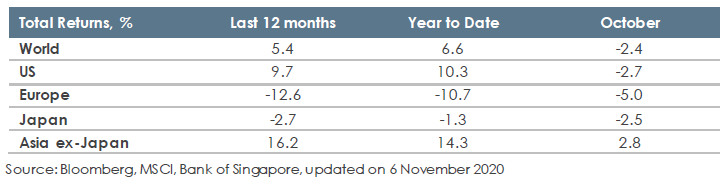

Bloomberg Us Dynamic Balance Index Ii Annual Point To Point W Spread - The annualized rate of return for the most recent period, which also happens to be the highest period was 2.70% the lowest 10 year period had an annualized rate of return of 1.75%. Index overview the bloomberg us dynamic balance index ii reflects the performance of an index strategy that uses the s&p 500® index and the bloomberg barclays us aggregate rbi® series 1 index.

Bloomberg Us Dynamic Balance Index Ii Review Mar 2021

50% s&p 500 / 50% bloomberg barclays u.s.

Bloomberg us dynamic balance index ii annual point to point w spread. It resets annually, which provides you with the opportunity to receive interest every year the index rises. Phased out for new contracts issued in 2020. In this example the index credit rate would be 6.0% after applying the cap rate.

Pimco tactical balanced index 5.29% annual yield. Actual performance and weights data are shown beginning 30 november 2017. Index performance for bloomberg us dynamic balance index (bxiiudbi) including value, chart, profile & other market data.

The bloomberg us dynamic balance index ii is comprised of the bloomberg barclays us aggregate rbi series 1 index, the s&p 500 ® index, and cash, and shifts weighting daily between them based on realized market volatility. Fidelity aim dividend index 1.83% annual yield. Prior to the actual launch of the index:

Blackrock ibld claria index 5.32% annual yield. Bloomberg us dynamic balance ii er index and pimco tactical. Bloomberg us dynamic balance ii er index is designed to dynamically manage volatility and is available for select life insurance and fia products.

Index performance for bloomberg us dynamic balance index ii (bxiiudb2) including value, chart, profile & other market data. Bloomberg us dynamic balanced index ii 6.44% annual yield. Bloomberg dynamic balanced index ii with annual point to point with a participation rate:

The bloomberg barclays us aggregate rbi series 1 index is comprised of a portfolio of derivative instruments plus cash that are designed to track the bloomberg barclays us aggregate. Rate 67% 87% nasdaq 4.25% pimco tactical balanced index 2.65% pimco tactical balanced index 3.40% Rate 70% 90% nasdaq 4.75% pimco tactical balanced index 1.90% pimco tactical balanced index 2.40%

The pimco tactical balanced index incepted on 7 december 2015.

Layanan Premier Ocbc Nisp

Annuity Gator - Barclays Us Dynamic Balance Index Ll

Bloomberg Us Dynamic Balance Index Ii - Index Cfd

Bloomberg Us Dynamic Balance Index Ii Review Mar 2021

Bloomberg Us Dynamic Balance Index Ii - Index Cfd

Financial Stability Review May 2018

Bloomberg Markets The Close 922021 - Bloomberg

Bloomberg Us Dynamic Balance Index Ii Review Mar 2021

2 Outlook And Policy Issues For Latin America And The Caribbean In Regional Economic Outlook October 2011 Western Hemisphere

Balance Of Power 10152021 - Bloomberg

Bloomberg Us Dynamic Balance Index Ii Review Mar 2021

Annuity Gator - Barclays Us Dynamic Balance Index Ll

Bloomberg Us Dynamic Balance Index Ii Review Mar 2021

Allianz Core Income 7 Fixed Indexed Annuity Review - Advisorworldcom